Do you want to know how scammers get away with the use of stolen credit cards and how to detect and ban them before they commit fraud using the stolen cards on your system? Then come in now and read our article on scam credit cards.

Not all purchases done online are legitimate. There are scammers that specialize in purchasing goods with stolen credit card details. You wouldn’t want to deal with such scammers on your site as their fraudulent activities with not only cause you chargebacks but can also get you penalized if it is done on a large scale on your e-commerce site. The use of stolen cards to purchase goods has been around for a while now since the e-commerce industry started. However, the methods used have been increasingly becoming sophisticated.

For you to stop them, you need to know how the whole scam is carried out and then learn how you can protect yourself from the activities of fraudsters using scam credit cards for on the Internet. In this article, we’ll take a look at the methods fraudsters use to get the credit cards of victims, how they use the credit card details, and how to stay protected from them.

How fraudsters might illicitly collect Credit Card Numbers

Criminals are constantly finding new ways to scam people out of sensitive financial information, including credit card and bank account details. Here are some of the most common tactics:

- Buying stolen payment card data from the dark web and then selling it to other criminals.

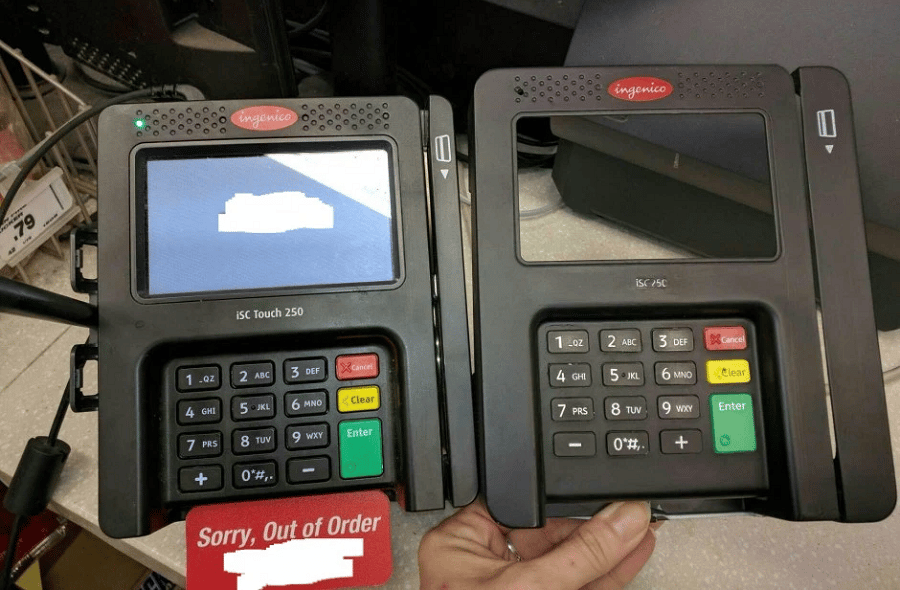

- Using card skimmers on point-of-sale terminals to collect credit card information, especially at gas station pumps.

- Conducting online phishing schemes that trick people into voluntarily giving up their credit card or banking information by posing as legitimate companies.

- Exploiting massive data breaches to acquire large quantities of credit card numbers in a short amount of time.

These tactics can result in the theft of sensitive financial information from millions of people, making it important to always be vigilant about protecting personal information online.

What are Scam Credit Cards?

Scam credit cards are credit card details stolen by fraudsters from unsuspecting victims with the plan to sell the details or use the details themselves to make purchases online. Another name for scam credit cards is stolen credit card. This is a type of scam that has been happening on the Internet for a while now. While reputable sites integrate methods to make it difficult for stolen cards to be used on their platforms, there are small e-commerce stores that do not and these fraudsters use these sites as the medium through which they are able to use those stolen cards.

There are basically two types of scam credit card usage — card present and card not present credit card scam. For the card present scam, scammers will need to have a real credit card or a clone copy present to use them. On the other hand, the “card not present” scam does not require the physical presence of the card — only the details are required. While the card present scam has reduced drastically, the card not present is increasing and this is for obvious reasons. The card not present let the fraudsters use the card with an increased likelihood of getting away with it.

How Does Purchase Using Stolen Credit Card Work?

The use of stolen credit cards for purchases is not straightforward. This is because one does not know how much is loaded on the credit card and the information assigned to the card such as the billing address. Credit card thieves use a method known as testing credit cards to see whether a credit card is usable by them or not.

If they have a bunch of credit card details, it is impossible and time-wasting to try all of the cards manually. Instead of that, they use bots or even a botnet to make the process distributed across different machines, IP addresses, and locations in other to hide their activities. Each card is used for small amount purchases via automated means using a bot. The idea is here is to see which accounts have money in them and are usable.

They keep track of the ones that work and dispose of the ones that failed for the small transactions. They then use the ones that work for whatever usage they intend. Usually, the more security feature a card has, the more difficult it is for them to make use of it in their automated credit card testing method.

Methods Fraudsters Get Scam Credit Cards

There are many ways scammers can get stolen credit cards. The most obvious way is by physically collecting the card until pressure. But this will most likely be reported. What are the other methods they use to collect credit card details without the victims knowing? Let’s take a look at some of these methods.

-

Using Credit Card Skimmers

Credit card skimmers are devices that can be used to read the details of credit cards. They are usually installed on ATM machines and POS devices. Unsuspecting users of these machines will then get their credit card details stolen without even realizing it. Fraudsters do this usually at ATM or POS points that have little to no monitoring as this gives them the ample time to install the devices. That is why fuel station's POS machines are usually a prime target since the staff there are usually not close to the POS points.

-

Website Data Breaches

Another method scammers use to get access to credit card details of unsuspecting victims is when they are able to successfully breach the security of a site that requires credit card information. When successful, they have access to a lot of information including Social Security Numbers, passport details, and even credit cards. The data is available either in the database or they monitor the requests coming to the server and steal the credit card information send. Many websites encrypt credit card details to recent this kind of attack. Some decide not to even collect data all together.

-

Online Phishing Scams and Attacks

Another method scammers use to get credit card details from Internet users is phishing scams. In this type of scam, the scammers design a site or email and make it look like it is from a legitimate company they know. The goal here is to get you to provide your credit card details. If you are not experienced, you will fall for this kind of scam as they bank on the trust a known brand has built over the years. However, if you take a look at the URL or the email address used carefully, you will uncover this.

-

Account Takeover

Account takeover is the process whereby criminals take over control of your account. Before this is possible, such criminals will need to have control of your phone number or email address. With this, the user could request access. Some can go as far as having your ID cards at hand to use for verification purposes. The moment such a user gets control of your account, they can now have access to not just your credit card but for other details of your account. This can be more lethal compared to just getting your credit card details.

-

Social Engineering Fraud

Social engineering is one of the popular methods cybercriminals use to obtain credit card details from their owners. Unlike the other methods described above that the owner does not give the details willingly, in social engineering, the users are cajoled into doing so.

They convinced you to provide you credit card details either posing as your account manager or representative of some company that wants to gift you money. The goal is to cajole you enough to provide them with the required credit card details. The moment you do that, they can now use your card for whatever usage they intend.

How Scam Credit Cards are Used

It might interest you to know that stolen credit cards are not used in a conventional way. And if you are looking at the conventional methods, you might end up not catching them. Below are some of the ways stolen credit cards are used by scammers and cybercriminals.

-

Trading Details on Dark Web

There is a risk involved when using stolen credit cards. And not knowing how to use them will surely get one caught. That is why many cybercriminals that steal credit card details do not use them. Instead, they are sold on the dark web to those that have expertise in using stolen cards. The price ranges from $20 up to $150 per credit card detail depending on a lot of factors. There are criminals that specialize in the use of stolen credit cards and the dark web is where they buy them from. For most cybercriminals engaged in stealing credit cards, selling them is just the easiest way to dispose of them without risking being caught.

-

Purchase of Virtual Gift Cards

It might interest you to know that virtual gift cards enable these credit card thieves. This is because the purchase of physical goods will give them out one way or the other. It is important you know that these cybercriminals do not use stolen credit cards just like that. Because the cards are available in their numbers, they test them via automated means to purchase small-priced items and keep a record of the cards that were successful.

They then use these cards to make bigger purchases until one card's financial value is wiped out. Some of the popular e-commerce platforms they purchase gift cards from without getting caught include Amazon, eGift, CashCard, and BestBuy.

-

Smaller E-Commerce and Scam Enablers

There is a convention and standard for processing credit card payments that make it possible for law enforcement agencies and financial intelligence agencies to catch credit card scammers. This is what makes the bigger platform unfavorable to credit card thieves. Unfortunately, not all sites follow these conventions and standards. There are some smaller sites that allow fraud to fly under the radar on the platform.

These kinds of sites become the means through which these credit card scammers are able to make use of their stolen cards. It might interest you to know that some of these sites, they are able to purchase physical goods that will be delivered to a safe location for them to pick up.

-

Earn Illegitimately from Affiliate Revenue

Because of the risk involved in using stolen cards, cybercriminals that engage in stealing credit card details do not use them to purchase items directly. They use a non-risky method of purchasing online products using multiple accounts and then earning from the affiliate commission. You see, there are some services that pay up to 40% — 50% commission for each sale made via your affiliate links. What these fraudsters do is that they use the stolen cards to make purchases and claim this commission. This is one of the most risk-free methods used by credit card thieves to launder stolen money without getting traced.

Why & How Criminals Test Credit Card Numbers

Once the fraudsters are done testing the credit card numbers, they start using the active ones to make larger purchases. Virtual gift cards make it easy for criminals to collect stolen goods from victims, even if they are far away. If actual goods are purchased, they may be shipped to an address that is hard to track or stolen from the recipient by porch pirates.

Criminals have easy access to stolen payment card information online. However, not all of the stolen credit card numbers work because cardholders eventually detect the fraud and the card number gets changed.

To make this scam profitable, the fraudsters have to test the credit card numbers. They use botnets to test multiple card numbers at a time, rather than entering the information manually.

The bots make low-cost purchases on small e-commerce sites, recording the credit card numbers that work and discarding the ones that don't.

Once the fraudsters finish testing the credit card numbers, they start using the active ones for larger purchases.

Virtual gift cards make it simple for criminals to receive stolen goods when they are not near their victims. If actual goods are purchased, the packages are often stolen from the recipients by porch pirates or shipped to an address that is hard to track.

How to Stop Credit Card Fraud

If you own a site, you will need to keep fraudulent transactions out of your site, and stopping credit card fraud is one of such transaction. In this section, we will take a look at some of the methods you can use to check for credit card fraud.

-

Monitor Transactions

When it comes to the pointers of the potential use of stolen credit cards on your platform, just look at your data. Take a lot at the transaction data and look out for unusual purchases. Are you suddenly having low-cost orders done in their numbers with some of them failing? Then there is every chance a credit card criminal is testing a credit card. Because the card is not there, they do not know which is loaded with funds and which is not. The only way to know that is by testing them will small orders before making bigger purchases.

Another pointer is if you are getting an unnatural number of purchases from a location you do not regularly get. The thing is, you need to be familiar with your transaction and site traffic analytics — and have your average performance data. If you notice a considerable difference with irregularities, you can tell for sure you are dealing with a credit card fraudster and then decide to block a such person. You can also force the person to go through some form of scrutiny.

-

Verify Addresses and Require KYC

As you should already know, most of these credit card fraudsters banks on the fact that you won’t do a lot of verification. First, the cards are not theirs and for the most part, they do not know the real address attached to the card. If you try to verify the address attached to the card and the billing address used by the fraudsters, you will most likely get them. But this will means you also record some collateral damages in the case of people that got their address changed. KYC also put a lot of fraudsters away from your site.

-

Use Fraud Protection Solution

Doing the monitoring yourself is a lot of work. And you will most likely not get it right. Instead of doing it yourself, you are better off making use of the anti-fraud systems developed to fight against credit card fraud. These services are dedicated and built from the ground up for these kinds of tasks and are better equipped as they have expertise in doing so. Some of the popular anti-fraud tools that offer protection against the use of stolen credit cards include SEON, Anura, and Stripe Radar.

While using a fraud protection tool like SEON is the best way possible to prevent this kind of fraud, they also do not come cheap. The sophisticated anti-fraud systems will cost you good money that only businesses only making enough profit will be able to afford. You will really need to do your homework and search for the best credit card fraud protection tool that is within your budget.

FAQs About Scam Credit Cards

Q. How Prevalent is Credit Card Fraud?

Credit card fraud and unauthorized charges are more common than you think. According to an annual report in 2021, about. 50 percent of Americas have experienced unauthorized charging of either their credit or debit card. And this is not just an American thing.

So far people are making fewer purchases with cash and more with cards, this will only keep rising until the technology in place is able to take care of this properly. While some of the big e-commerce platforms have systems in place to deal with this, their defense is still porous to these cybercriminals for now.

Q. Is the Use of Stolen Credit Card Illegal?

The use of stolen credit cards is illegal. The money in the card is not meant for the fraudsters and this is a jailable offense. On no account should someone purchase stolen card details no matter how cheap they are as you can get into trouble.

On your own part as a site owner, you are better off also preventing users of stolen credit cards on your platform. This is because your site might be seen as aiding and awaiting credit card fraud and that also has its own penalty especially if you do not have systems in place to discourage such practices.

Q. Can Stolen Credit Card Usage be Prevented?

The use of stolen credit cards can be prevented. However, this does not come easy or cheap. Fraudsters are increasingly becoming sophisticated as some can find out all of the information of a person including his address to be able to perfect their scam.

While you cannot always catch these cybercriminals, if the right fraud protection system is in place, there are chances you will catch a large portion of them. Plus, you also will have proof to exonerate yourself if you are accused of aiding and awaiting it.

Conclusion

It is important you know that not all purchases of goods and services on your e-commerce platform are legitimate. Some are made with stolen credit card details and as such, do not fall under any sphere of legitimacy. You will want to avoid such kind of transactions to avoid getting into trouble with financial intelligence units. This article provides you with a gentle introduction to how to protect yourself from this kind of transactions.