You just heard about alternative data and want to learn more about it? Then be our guest as we walk you through all you need to know about alternative data, including what it means, its sources, and uses, among others.

Regular investors make investing decisions using the information provided by businesses themselves, which includes SEC filings, financial statements, press releases, and presentations. While these sources are excellent, the management team of the company can be economical with the truth, hoard information for too long, or even skew it.

The fact that investors will have to wait for too long to get information from businesses coupled with the integrity of the information provided has led large investors such as hedge fund and other institutional investment companies to source other sources that will provide them data that can be used as a true measure of performance of a business or company.

As an investor, the alternative data field is important as it gives you the power to make decisions without depending on the information provided by businesses you are interested in. this could help you make better and timely investment decisions.

What is Alternative Data?

The term alternative data is used in the investment circle to mean data that could be used for making an investment decision on an asset – but is not provided directly and or officially by the team behind the management of the asset.

Take, for instance, any data you could use in making an investment decision about a certain company without it coming from the company is known as alternative data. While you will be quick to think of it as insiders’ knowledge, you will have to disabuse your mind – as an investment based on insiders’ knowledge is illegal.

Generally, there is a good number of sources, with many coming in an unstructured format, and you will have to do a lot of cleaning and structuring to get insight. Originally, the field was informal and unregulated, and as such, everything goes. It has now grown into a field known as an alternative investment, and there is an agency set up to oversee it. the name of this agency is Standards Board for Alternative Investment (SBAI).

Why Use Alternative Data

Before we go deeper, it is important you know that alternative data shouldn’t be used as a replacement for official data, but they should serve as complementary data.

In many cases, you will need to find a correlation between the alternative data and official data available, and only where there exists a correlation should you consider them valid enough for decision making. You can see alternative data as data you could use to validate official data. There are a few reasons why you should make use of alternative data.

- Make Timely Investment Decision

The performance report is provided at time intervals, and investment experts might not have the patient to wait for earning reports and other performance reports to be released before making investment decisions. They could make use of alternative data that have proven to be correlated with performance reports released by companies to make a decision.

- Gain a Competitive Advantage

One of the reasons why hedge funds and other large investors are more successful than the smaller investors is that they make use of alternative data to get an idea of the performance of a company before reports are released.

Many smaller investors wait for the earnings report of a company before making an investment decision on the company – and this is seen from the sharp rise in price after a good earnings report and earnings beat.

Companies that make use of alternative data do not have to wait for earning reports – they are right on time before others come in, thereby making them the biggest winners. On the flipside, alternative data can give you the headway and get you to sell your shares before any report that will get others to sell.

- Complement Official Reports and Data

Alternative data can serve as complementary data for you to make investment decisions. There are instances that reports are not released, or the report is not detailed enough. In other instances, you can become skeptical about the report and data churned out by the company – and you will need to go on a fact-finding project.

By employing an alternative investing process and using alternative data, you can find out if there is a correlation between official reports and actual performance from alternative data.

Types of Alternative Data

-

Geographic Information System (GIS) Data

You will agree with me that businesses have geospatial context, and using imageries from satellites across different periods, you can determine if a business is having an increase in customers or the number of customers they have is on a decline.

Some investors have their ways of tracking foot traffic either through WI-FI signals, Bluetooth beacons, or other methods. With information on foot and vehicular traffic, investors can gauge the performance of a particular epoch compared to another.

-

Website and App Analytics

Obviously, there is no software you can use to determine the actual traffic a site has – and many businesses will not provide you that. However, there are some web services, including SimilarWeb and Alexa, among others, that can provide you with traffic data about a web service.

For the app performance, you can scrape and track the performance of the app on major app stores, including Google Play and Apple App Store, to determine what customers think about the business. You can get an incredible amount of information from customers' reviews, and when this is tracked over a period of time, you can now have reviews from different periods to gauge performance.

-

Transaction Data

No business will allow regular investors access to their transaction entries in its raw form. For this reason, you will need to make use of third-party services that can trail credit card transactions. It is important you know that not all of the transactions will be trailed, but you will get a sizable number you could use for decision making.

-

Price Data

When using the change in price as alternative data, you have to consider some factors, including period and competition, as this could provide a different interpretation.

-

Online Mentions and Browsing Activities, Sentiment Analysis

Social media is one of the platforms you can get a lot of users’ discussion about businesses – and from there, you can tell if there is an increase in demand for the services provided by a business – or the customers' complaints have increased, which is a sign of failure looming. This is done via scraping texts from relevant web pages and carrying out sentiment analysis and volume on the scraped data.

Aside from social media, there are many discussion forums and blogs you can get information from. Google can also be a source of data for alternative data and online competitive analysis. An increase in the number of keywords a web service rank for -and a bump in ranking would correlate to an increase in revenue.

In the same way, when a web service that Google is one of its largest sources of traffic has a considerable drop in search performance, this will most likely affect their revenue, and as such, even before an earnings report is provided, you already know what to expect.

-

Survey

Another type of alternative data that can be used for investment decisions is data gotten from surveys. Above, I made mentioned of carrying out sentiment analysis on a text – while this can provide you an idea of what customers think about the business, there is no better way of knowing this than to ask the customers directly.

Surveys can be helpful, and depending on the way the questions are structured, you can get incredible data that will help you know how users think of a business they patronize – or have an interest in. However, you need to know that for this to be correct, the survey has to be of high-quality, and the providers have to be excellent in their job to avoid giving out your survey to a low-quality audience.

-

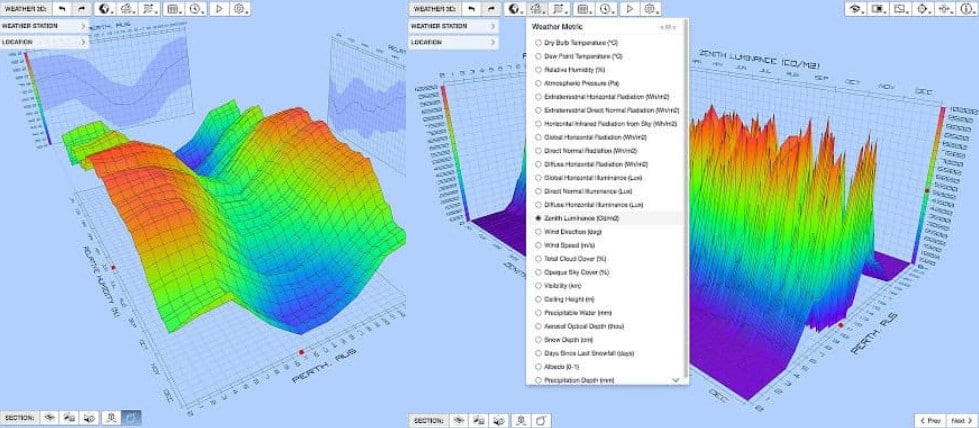

Weather Data

However, you cannot always use them. They become important when there is an extreme weather condition or disaster. From the weather data and imageries, you do not need a company that produces grains to tell you that they could not beat their previous earning due to a change in weather conditions – you can tell that yourself.

-

Email Receipt

For retail stores online, email receipts can be collected and analyzed to draw a conclusion on the sales data. This is not provided to any investor by the business, and as such, you will have to either get a third-party that provide such services to help you out.

Some of the providers reward consumers for providing their email receipts for their analysis. It is important you know that you cannot get all users to opt into the service and provide you receipts. You will have to rely on samples to make your decision.

Aside from the above, there are many other data types and sources you can use as alternative data for investment purposes.

How Effective is Alternative Data for Investment Purposes?

Alternative investment, which is the type of investment decision made with the help of alternative data, is effective and has helped hedge fund managers and other large investors that could assemble a data team to provide them the required data they will have Key Performance Index (KPI) to use for gauging performance.

However, you need to know that how effective alternative data is for investment depends on the type of data involved. Some of them are more effective than others – and these are more difficult to access. Take, for instance, transaction data that provide more insights than using satellite images and foot traffic data. Out of the alternative data types, transaction data and data scraped from websites, and social media pages are the most used.

Conclusion

Earning reports and other performance data are not manufactured out of anywhere – they are drawn from the business transactions and activities a business has engaged in – and you can make use of some of these activities that could be used as KPI because of their historical correlation with official performance data to make decisions even before official data is released.

The field is still in its infancy, dominated by people without graduate degrees in it – but with a lot of potentials and increase in it, interest grows every year.