The e-commerce sector has seen explosive expansion over the past two to three decades.

So much so that, as of 2021, more than 30% (2.14 billion individuals) of the global population have used at least one or two e-commerce websites for digital purchases and sales. These transactions occur between the same or different regions around the world.

As such, for smooth and seamless transaction processes, there is a need for a good payment system or platform that is secured, trusted, and fast for both the sellers and buyers to ensure everyone goes home happy. Among many out there is Paypal.

Established in the late 1990s by Confinity, Paypal was one of the first online payment systems that became popular and were adopted as the main payment system for eBay users at the time following its acquisition by eBay in 2002.

Providing an online payment system or platform that enables people or businesses to send money electronically using verified accounts on their platform is PayPal's primary business. Many e-commerce companies now accept PayPal as a compatible online payment method for their goods and services, including cryptocurrency transactions.

In this post, we'll look at some PayPal statistical data to help us understand how much the platform has developed and why so many online services that handle money transfers are interested in using it.

Key PayPal Statistics You Need to Know in 2023

- PayPal has 429 million active and verified user as of Q1 2022.

- Over 505,198 to 770,793 websites support PayPal as a payment method as at July 2021.

- PayPal has a total valuation of $237.37 billion as of November, 2021.

- PayPal recorded a $4.1 billion net income in 2021.

- Largest population of PayPal user base are baby boomers (45 and 55 years and above)

eCommerce Statistics, Facts & Trends 2023

How Many People Use Paypal?

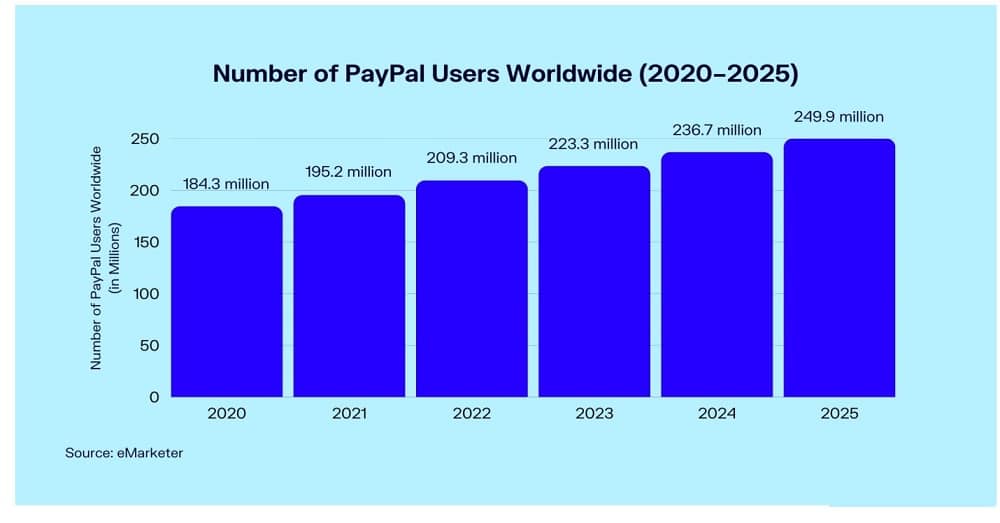

One of the most popular methods of online payment is, without a doubt, PayPal. As such, they have a huge number of online users. According to Statista's projections, the company's 277 million users in Q1 2019 increased to roughly 377 million by Q4 2020, a significant increase during the COVID-19 pandemic.

Currently, Paypal has more than 429 million active users as of Q1 2022. Compared to the 426 million customers they had in Q4 of 2021, the online payment giant has added roughly 3 million users (0.9%). By the end of 2023, this figure is anticipated to reach 500 million users.

You maybe like to read,

What is the Demography of Paypal Users?

Having seen the significant growth of PayPal's user population. We are going to discuss the demographics of its users on two fronts – age and sex.

-

Age

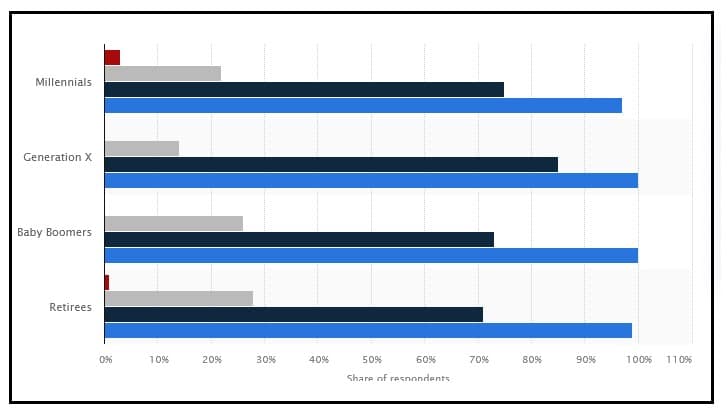

Surprisingly, between March and April 2020, the age group of PayPal users 50 and above experienced the largest growth. Back in 2016, 73% of PayPal users were also members of the baby boomer generation. In 2021, an online age comparison of PayPal users' research was conducted in the United States.

The result of the research showed that 14% of users are aged 24 and below, and another 25% are aged between 25 and 34 years. 19% are between 35 and 44 years old. 20% are between 45 and 55 years old, while 22% are 55 years old or older. This further shows that PayPal's thriving users by age are those aged 45 to 50 and above.

-

Sex

According to a poll conducted in the United States by Statista in July 2017, It revealed that women used PayPal's mobile app more frequently than men, with a total of 18 million monthly users compared to 14 million male users.

In a further poll done in 2021, it was discovered that 52% of PayPal users identified as female. This shows that while handling an online transaction or payment, women use the Paypal platform the most often.

[Sources: Electronic payments international, Statista, Web tribunal]

What is Paypal's User Registration Fee?

Currently, opening a PayPal account and registering for one is free of cost. But in the early years of the business, PayPal imposed a membership fee on all new customers. When enough people signed up, they reduced the charge from $20 to $10 and finally to $5 for each new user.

Fortunately, a large number of individuals became aware of PayPal and what they were offering because of the decrease in fees. Even if there are no longer any sign-up or membership fees, users still have to pay a fee whenever they conduct any transactions.

[Source: Spendmenot]

How Many E-commerce Websites Adopt Paypal as a Payment System?

PayPal is arguably one of the payment methods that fit all e-commerce transactions. Because it is one of the most practical ways to make online purchases, it is widely recognized. Although PayPal is useful and helpful, not all internet shops accept their payments. Over 505,198 to 770,793 websites use PayPal as a payment method as of July 2021.

In the previous month, 3,221 dropped PayPal's service, but Over 8,466 businesses onboarded them. Over 565 websites in the United States provide PayPal Credit.

They also advertise their services on roughly 25 Canadian websites. Other countries include China with 8 approved websites, Germany with 11, Australia with 11, India with 10, and the United Kingdom with 14 supported websites.

[Source: Litextension, MoneyTransfers, Ewebmarketing, BalancingEverything]

What Type of Transactions Do People Use PayPal for the Most?

Over 90% of PayPal users use the platform for e-commerce sales and purchase transactions. Others use PayPal for the electronic transfer of funds. Sometimes to accounts within the United States, other times from or to accounts outside the United States.

Furthermore, because PayPal is preferred over traditional bank accounts in America, about 1 in 5 Americans store their money there. Recently, PayPal gave users the option to make cryptocurrency transactions on their platform. Although, not all of their users have taken advantage of this.

[Source: MoneyTransfers]

How Does Paypal Generate Revenue?

In essence, PayPal makes money in a variety of ways. First, fees on payment transactions are where PayPal makes the vast majority of its revenue. Customers and merchants pay net transaction fees for each transaction handled through their platform. Paypal typically charges a flat fee of 2.9% + $0.30 for accepting payments for purchases made within the United States.

On the other hand, if the money is coming from a foreign PayPal account. A transaction fee of 4.4% plus $0.30 is levied by them. Lending is another revenue-generating channel they use. PayPal provides its merchants with choices for financial loans to support them through lean business periods. Others include their digital wallet, Venmo, and partnership fees.

[Source: Seeking Alpha, Hiveage]

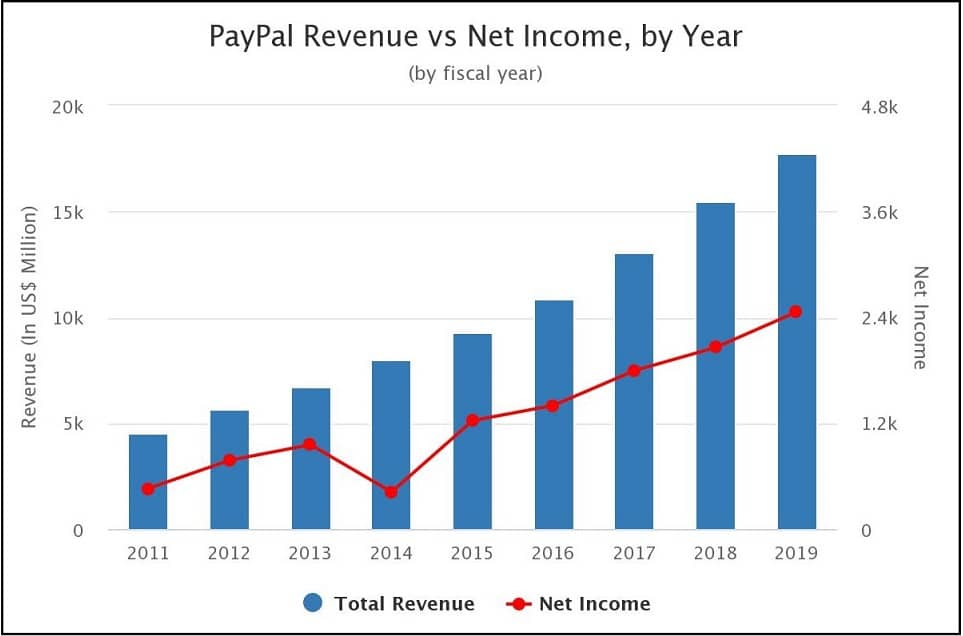

What Is Paypal's Revenue?

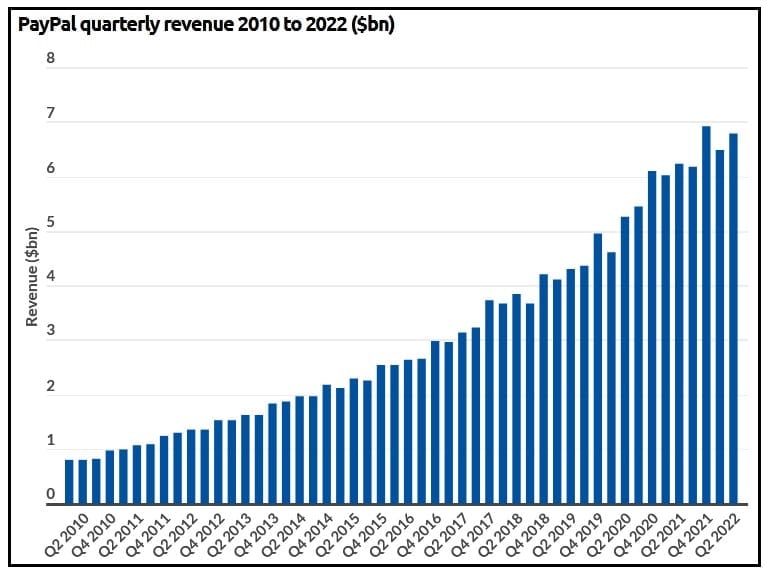

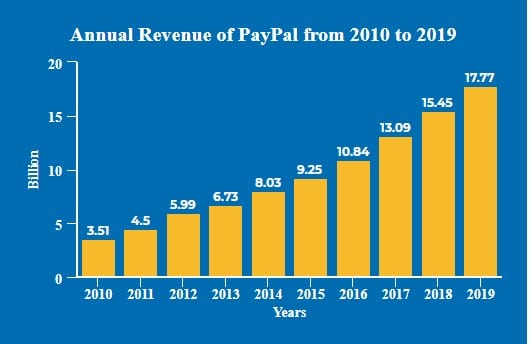

Looking at their 2019 revenue, Paypal brought in $17.75 billion. Increasingly making use of the pandemic in 2020 and their expanding user base. Over $21.45 billion in transactional revenue was generated in 2020. PayPal had a successful financial year in 2021.

PayPal had a strong annual revenue of $25.4 billion at the end of the fourth quarter of their fiscal year 2021. This was an increase of 17% from the previous year.

Currently, their revenue has grown by 4.01% ($26.38 billion) in 2022. By the fourth quarter of 2022, PayPal's revenue might total $30 billion due to the company's steady user growth.

[Source: MoneyTransfers, Companiesmarketcap, Buybitcoinworldwide]

What is Paypal's Profit in the Last Decade?

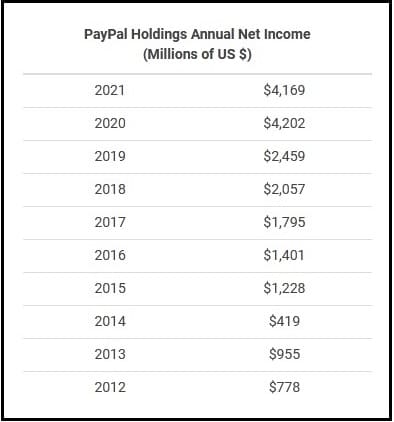

With regards to the huge financial achievement made by PayPal as of Q1 2022. PayPal recorded $4.1 billion net income. This is slightly below that of the previous year. Between 2012 and 2021, their profit margin was as follows:

| YEAR | PROFIT |

| 2012 | $0.8 billion |

| 2013 | $0.9 billion |

| 2014 | $0.4 billion |

| 2015 | $1.2 billion |

| 2016 | $1.4 billion |

| 2017 | $1.8 billion |

| 2018 | $2 billion |

| 2019 | $2.4 billion |

| 2020 | $4.2 billion |

| 2021 | $4.169 billion |

This suggests that even with the ongoing development in sales and new clientele. For the past ten years, PayPal has not generated a steady and regular profit. There are a variety of explanations for this.

[Source: Buybitcoinworldwide, BusinessofApps]

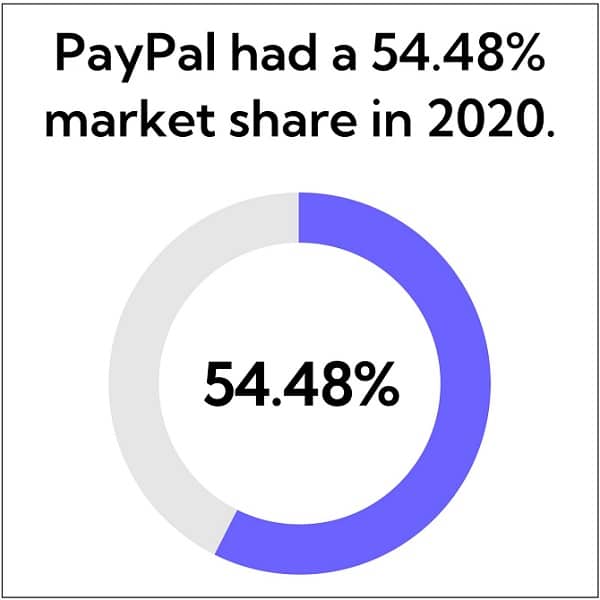

What Is Paypal's Market Share In The Payment Management Market?

PayPal's market share increased to roughly $49 billion in 2015 when it separated from eBay. Imagine the year 2020, when PayPal's market share of the entire online payment processing market was 54.48%. PayPal has been able to maintain its level of excellence despite the availability of numerous alternative payment processing methods.

They outperformed Stripe (19.14% market share) and Amazon Pay (3.88% of the market), who were their rivals. Additionally, PayPal accounts for around 14% of all digital transactions made in the US. This demonstrates that PayPal is still able to function despite the limitations placed on its service in some nations.

[Source: MoneyTransfers, Buybitcoinworldwide]

What Regions Of The World Uses Paypal The Most?

No matter where you are or what language you speak, you can send and receive money with PayPal. Although there are a few geo-restrictions on PayPal in some countries. Users in more than 200 nations in Asia, Europe, the Americas, and Africa can access PayPal.

The majority (43.86%) of PayPal users are in the United States. In Germany, there are 17.61% of users. In the UK, there are 14.39%. According to the aforementioned data, PayPal has the greatest user base in the American and European continents.

[Source: PayPal, Fortunly, Ewebmarketing]

How Many Countries Have Restrictions On The Use Of Paypal?

Even though PayPal is accessible to a large number of users worldwide. Some nations do not permit the use of PayPal as a method of online payment. Some of these nations are dispersed throughout the globe in various areas. PayPal doesn't maintain a list of unsupported regions as a result.

However, based on a comparison between the list of UN members and the list of countries that PayPal supports.

PayPal is not supported in about 28 countries. Afghanistan, Bangladesh, Cameroon, Central African Republic, Cote d'Ivoire (Ivory Coast), Democratic People's Republic of Korea (North Korea), Equatorial Guinea, Gabon, Ghana, Haiti, Iran, Iraq, Lebanon, Liberia, Libya, Monaco, Moldova, Montenegro, are among these countries.

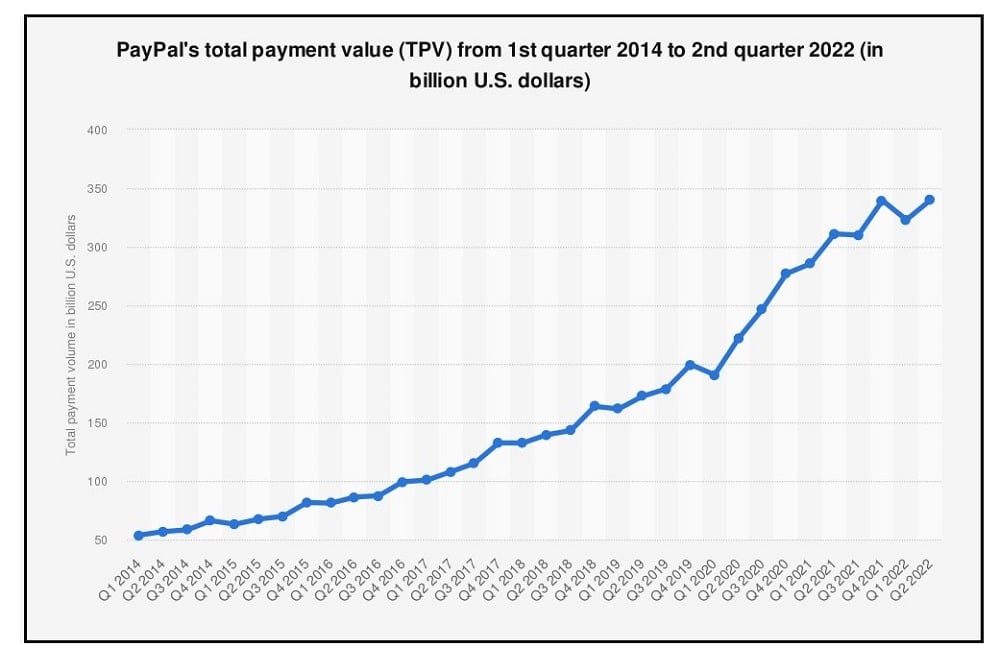

What Is Paypal's Daily Transaction Volume?

Given that 45% of customers use PayPal to make online payments every week, it goes without saying that PayPal conducts a sizable number of transactions every day. The cumulative daily transaction volume for the year was 12.36 billion as of the fourth quarter of 2019 according to PayPal.

Therefore, if we divide this number by the 365 days in a year, the average daily number of PayPal transactions in 2019 would be 33.86 million. Let's take a closer look at daily transactions by the number of users by country as well.

With over 300,000 transactions each day, Germany and the United Kingdom are Europe's leading performers. As a result, PayPal processes daily payments totaling over $2.5 billion.

[Source: BalancingEverything, MoneyTransfers, WebTribunal]

What Is The Amount Of Transactions Per Account On Paypal?

People conduct internet transactions on a daily basis. Whether it be for a transfer, buy, or exchange of currency pairs. A 2019 survey found that the typical PayPal user completes 40 transactions annually. Thankfully, this figure remained unchanged in 2020 as well.

However, the average transaction per account increased by around 12.5% over the prior year in 2021. Therefore, each PayPal user account currently engages in about 45 transactions per year.

[Source: Fortunly, BusinessofApps]

Who Are Paypal's Major Competitors?

For many years, PayPal has been at the forefront of the sector's innovation. As a result, new industry participants have emerged as the internet payment sector expands quickly. As such, Amazon Pay, Square Payments, and Stripe are the top 3 competitors of PayPal.

According to the most current market share statistics, these are the next two best-performing payment processors after PayPal. There are numerous other rivals, such as Braintree, Google Wallet, Wepay, Skrill, Intuit, etc.

[Source: Medium, Wallstreetzen]

How Much Was Paypal Purchase For In 2002?

Confinity founded PayPal in the late 1990s. In October 2002, eBay purchased PayPal for $1.5 billion. After seeing PayPal become the top option for Internet auction shoppers, eBay purchased the payment processing pioneer. It was signed in 2002. (the same year PayPal went public). eBay's own online payment service, was replaced by the new acquisition.

With the aid of this money, PayPal's creators were able to significantly alter the modern technology landscape. Although, PayPal became an independent business in 2015 after splitting from eBay.

[Source: WebTribunal, Britannica]

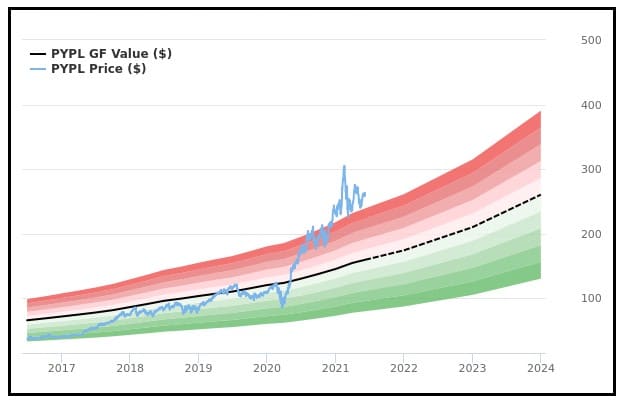

What Is Paypal's Current Valuation?

PayPal’s market value grew to $49 billion just one day after splitting from eBay in 2015. Like a majority of the stock market then, PayPal's shares dropped for a spell in the first quarters of 2020. But the company managed to pick itself up to pre-pandemic levels fairly quickly, with no losses in the number of shareholders willing to invest in the publicly traded company. PayPal has a total valuation of $237.37 billion as of November 12, 2021.

[Source: Buybitcoinworldwide]

How Many Employees Does Paypal Have?

In 2020, PayPal employed a total of 26,500 people. The majority of PayPal's staff employed worked in technology, with a considerable percentage in sales. Only about 5% work in customer service. Interestingly, PayPal employs 45% women and 55% males, suggesting that its workforce is more masculine.

White people make up the majority of PayPal's workforce (55%), followed by Asian people (17%) and Hispanic or Latino people (15%). 60% of PayPal employees fall within the 20–30 age bracket.

As a result, just 33% of PayPal employees work there for 1-2 years. But according to a poll, PayPal had a 16.6% increase in staff in 2021. (30,900 employees).

[Source: Buybitcoinworldwide, Macrotrends, Zippia]

How Many People Use The Paypal One Touch Feature?

PayPal One Touch, a feature that was introduced in April 2015, enables customers to log in without using their email address or password. This demonstrates the service's dedication to both ease and cutting-edge security. In December, the service reached its first 10 million PayPal users.

The One-Touch feature from PayPal is active on more than half of the Internet Retailer 500 retailers' websites. However, just roughly 18% (or 80 million) of the platform's 439 million customers make advantage of PayPal's One Touch automated sign-in option.

The service made a remarkable 87.5% online conversation rate in 2021. In other words, PayPal One Touch surpasses its principal rivals in this market by more than 50%.

[Source: Fortunly, BalancingEverything]

How Many Currencies Does Paypal Support?

When a consumer uses PayPal to pay for an order, the currency is shown in both the PayPal and the e-commerce or vendor checkouts. Despite the fact that PayPal accepts 26 currencies, there are certain discrepancies between the accounts for various nations.

For instance, PayPal customers in many other nations are unable to take advantage of some financial functions that are available to Americans. Additionally, for many currencies, the PayPal currency conversion rate is marginally less favorable than the major currencies.

Thankfully, your PayPal Business account allows you to save foreign currency balances. The conversion can then be set up by you at any moment.

[Source: Ewebmarketing, PayPal]

What Is The Average Amount Of Cash In A Paypal User's Account?

In a sense, fintech has impacted practically every aspect of the societal fabric. The practice of carrying cash in one's wallet or pocket has thus been replaced by cashless transactions. According to a recent research, an American, on average, prefers to carry $196 in cash in their wallet and an average of over $500 on their PayPal account.

According to more than 20% of respondents, they would rather leave their money on PayPal than in traditional bank accounts. It suggests that a large portion of them believe PayPal will protect their money.

[Source: WebTribunal, Spendmenot]

What Was Paypal's Top Performing Year?

To evaluate PayPal's best year ever. We may compare the sales and profit figures for PayPal over the previous ten years. According to statistics, PayPal Holdings had a breakthrough year in 2020. (PYPL). During the pandemic, the business was chosen by numerous customers as their digital payment processor of choice.

Over the course of the year, the stock more than doubled and reached a new high. Net revenue for the fourth quarter surpassed $6 billion for the first time, coming in at $6.1 billion. The best yearly result in PayPal's history was made possible by this trend. It's interesting to note that they recorded the largest net profit that year of $4.2 billion.

[Source: Montlyfool]

What Was Paypal's Worst-Performing Year?

Taking PayPal's recent market performance into account. PayPal experienced their worst year in 2021. However, investors' favorite investment during the epidemic was PayPal, with shares rising 111% in 2020. In the first half of 2021, there was an additional 25%. The stock, however, started to decline in the second half of 2021.

As PayPal's user growth slowed in the second half of the year, it dropped by 35%. A number of eBay billionaires who own minor PayPal stakes suffered a decline in their net worth.

For instance, according to Forbes, Meg Whitman, the former CEO of eBay and a shareholder in PayPal, saw a decline in her net worth from $600 million to $4 billion.

How Many Of Users Does Venmo Have?

According to Venmo usage statistics, this app, which PayPal has owned since 2012, will have 52 million users by 2020, up from 3 million in 2015. This was 18% of PayPal's user base for 2020. Families and social groups primarily utilize it to divide subscription costs and expenses.

If you currently accept PayPal, accepting Venmo payments on your company's mobile website is a built-in option. There won't be a Venmo button on your website when you take Venmo through PayPal. Instead, they will choose “PayPal Checkout” and have the choice of using PayPal or Venmo to make a payment. There is no extra cost associated with accepting Venmo payments through PayPal, and there is no additional setup required.

[Source: BusinessofApps, Businessnewdaily]

How Many Merchant Accounts Are On Paypal?

PayPal offers a few tools that let people shop online safely and conveniently. In the end, this benefits the business owners. Survey showed that there were 14.5 million active merchant accounts in 2016. Their numbers soon increased over the following three years.

According to official PayPal statistics, 23 million businesses used PayPal globally as of the second quarter of 2019.

However, the user base of PayPal in 2020 is estimated to be about 29 million verified and active merchant accounts. For merchants, using PayPal has made doing business online quite simple. Thanks to the lack of commitments and recurring charges.

[Source: BalancingEverything]

What Is Paypal's Transaction Fee?

You might be curious about the cost of PayPal transaction fees. PayPal charges a fixed processing fee of 3.49% plus an additional $0.49 for every transaction. It implies that you will pay out more in processing fees the more you send. Domestic credit or debit transfers made through PayPal incur a 2.9% cost in addition to a fixed $0.30 transaction fee.

PayPal charges 5% of the transaction when sending money internationally. A minimum cost of $0.99 and a maximum price of $4.99 apply to this. As a result, it is advised to avoid sending a tiny sum when using PayPal.

[Source: Indy, Tipalti , PayPal ]

What Are Paypal's Minimum And Maximum Transaction Limits?

A transfer limit is, as the name suggests, a ceiling on the amount you can send using PayPal in a single transaction. A one-time payment of up to $4,000 can be sent even if you don't have a PayPal account. The total amount of money you can send from your account is not capped; however, if you have a confirmed PayPal account.

A monthly withdrawal from a bank account of up to $500 is also permitted. A company may send as much as $60,000 in a single transaction, depending on your currency. There are no overall restrictions on the amount you can send using your PayPal account.

How Much Is Paypal's Share Price?

In 2002, the price of the platform's initial public offering (IPO) was $13 per share. This means that it has the sixth-largest market capitalization in the world ($295 billion). The stock price of PayPal is impacted by the COVID-19 epidemic. Even for major market firms, the year 2020 was incredibly difficult, but PayPal nevertheless managed to surpass expectations.

In 2020, almost 10 million PayPal users will have used the service to make in-person purchases. For a while during the COVID-19 pandemic, the shares dropped to $86 but later rose. The widespread use of digital payments caused PayPal stock to soar, rising nearly 132% since the COVID-19 outbreak. As of February 26, 2021, the PYPL stock price was $253.34.

[Source: BalancingEverything, Buybitcoinworldwide]

What Is Paypal's Checkout Conversion Rate?

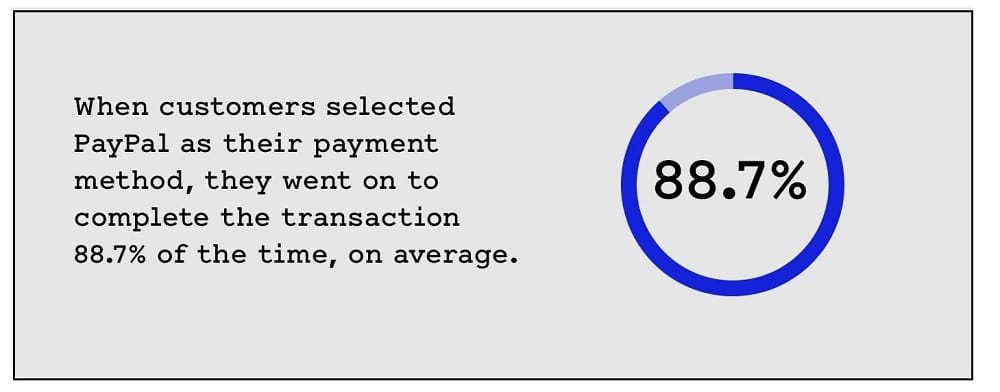

Compared to competitors, PayPal has a 70% greater checkout conversion rate. This figure can indicate that many PayPal users find it easier to utilize PayPal while checking out. Compared to many other kinds of payment, they call for the fewest details.

Additionally, because it is stored, credit card information can autofill. In 2018, the typical PayPal conversion rate was 88.7%. While the total conversion rate for all payment types was 48.7%, the average conversion rate for other e-wallets was 55.3%. PayPal compared the total conversion as well. Sites lacking Express Checkout had a poorer conversion rate of 41.3%, according to PayPal statistics.

[Source: MoneyTransfers, BalancingEverything]

What Is The Number Of Transactions On Paypal Via Mobile Devices?

Using smartphones to make payments, and send and receive funds has been on the rise in the last few years. Due to the expansion of fintech globally. PayPal has taken advantage of it to provide a free mobile app for Android and iOS users for the purpose of on-the-go transactions.

Therefore, more than 30% of PayPal transactions take place on mobile platforms. In fact, in the first quarter of 2019, PayPal's mobile transactions hit 52%. According to reports, more than 45% of PayPal customers send payments on a weekly basis.

Accordingly, studies have indicated that about half of all PayPal customers utilize the PayPal app to execute payments or transactions on mobile devices.

[Source: Ewebmarketing, MoneyTransfers]

Does Paypal Support Cryptocurrency Transactions?

As a leader in its field, PayPal is constantly coming up with innovative ways to satisfy its customers' expanding needs. So, in March 2021, PayPal declared that its American users may now make payments using cryptocurrencies. The new function was referred to as “Checkout with Crypto.” They enable the purchase, sale, storage, and transfer of cryptocurrencies into and out of PayPal.

All 29 million businesses that accept PayPal will accept payments made in digital currency from PayPal users. Bitcoin and other cryptocurrencies may be purchased securely for as little as $1. Transfers between individual PayPal accounts can be made using cryptocurrencies. The cryptocurrency market, however, operates continuously due to its nature.

How Many Investments And Acquisitions Does Paypal Have?

PayPal is extending its offerings beyond payment acceptance, including cryptocurrencies, banking, and e-commerce. Let's examine the company's partnerships, investments, and acquisitions.

Over the years, PayPal has established hundreds of strategic business alliances, made investments in over 30 diverse businesses, and even completed a few acquisitions in the last two years across a variety of industries, including e-Commerce Enablers, Cybersecurity, Payments, and more. 25 purchases and 63 investments have been undertaken by PayPal.

The deals cost the corporation more than $ 14 billion. The following companies were recently acquired by PayPal: Venmo, Honey, Paidy, IPos, Happy Returns, and Braintree, just to mention a few.

[Source: Tracxn, CBInsights]

How Many Physical Offices Does Paypal Have?

PayPal provides more than just service to its users; it is a leading global provider of SaaS. To react to inquiries and clients, a number of physical office locations are available.

In 31 countries, there are 56 PayPal locations. Numerous states, including Arizona, Nebraska, California, Texas, Germany, Singapore, Malaysia, Ireland, China, and India, are home to its hubs and offices. The operating headquarter of PayPal is not in upscale Silicon Valley but rather in Nebraska. 26,500 workers from 119 nations are employed by Paypal. of whom 55% are millennials.

[Source: Ewebmarketing]

What Is Paypal's Operating Expenses?

The costs incurred by PayPal to support its executive, risk, finance, human resources, and other support functions are included in its general and administrative costs. Hence, the breakdown of the operating expenses from 2019 to 2022. The yearly operating costs for PayPal Holdings in 2019 increased by 13.55% to $15.053 billion.

In comparison to 2019, PayPal Holdings' operating costs were $18.165 billion in 2020, a 20.67% rise. The yearly operating costs for PayPal Holdings were $21.109 billion in 2021, a 16.21% rise over 2020. Operating costs for PayPal Holdings were $6.042 billion, up 18.22% from the previous year, for the quarter ending June 30, 2022.

[Source: Macrotrends, Dazeinfo]

What Is Paypal's Operating Income?

PayPal's operational income from 2019 to June 2022, after all normal, recurring expenditures and expenses, is as follows: The operational revenue for PayPal Holdings was $2.719 billion in 2019, up 23.93% from the previous year.

The operational income for PayPal Holdings was $3.289 billion in 2020, up 20.96% from the previous year. 2021 saw a 29.58% increase in operating income for PayPal Holdings, reaching $4.262 billion. For the quarter ending June 30, 2022, PayPal Holdings' net income was $-0.341 billion, a 128.8% fall from the prior year.

[Source: Macrotrends]

What Is Paypal's Stock Forecast For 2022?

Do you wish to invest in and purchase PayPal stocks? Here is a PayPal stock forecast 2022. In 2022, PayPal's price was set at $188.58. PayPal traded at $99.11 as of August 17th, 2022, a 47% decline from the year's commencement.

By the end of 2022, PayPal is expected to cost $114.03; this represents a 40% annual change. The most recent long-term projection is that PayPal's price will reach $150 by the end of 2023. The price of PayPal will increase to $200 in 2024, $250 in 2025, $300 in 2027, and $400 in 2030.

[Source: CoinPriceForecast]

Conclusion

The statistics and information about PayPal on this page demonstrate that it dominates the market for online payment processing. Both their user base and revenue have seen notable growth. As it adds more active users every fiscal quarter, PayPal continues to rule the world of international online purchasing. With the various investments and acquisitions, PayPal hopes to keep its market share.